Some Known Facts About Payroll.

Signed tax paperwork and settlement, together with federal and state* tax documents and service agreementsThe amount would you owe towards the state or in your FUTA taxes? With this report, the thing is your payroll tax liabilities for federal, state and native taxes. Simple Payroll software shoppers can use this report back to deal with their payroll tax obligations.Scaling up your organization speedy? Increase your new hires towards your payroll in a couple of easy measures, and manage all their information and facts centrally.

How Payroll can Save You Time, Stress, and Money.

Getting The Payroll To Work

Getting The Payroll To WorkThis manner will provide you with information about Every employee’s federal money tax withholding, along with their name, address, and Social Stability range. You require all of this details to effectively run and distribute payroll.The bargains don't utilize to extra workforce and state tax filing charges. When you insert or remove products and services, your support costs might be modified accordingly. Gross sales tax can be utilized exactly where relevant. For being qualified for this offer you must be a different Payroll purchaser and Join the month-to-month plan using the “Free 30-Day Demo” selection. This offer you can’t be combined with another QuickBooks features. Supply readily available for a constrained time only. To cancel your subscription at any time contact 866-272-8734 or check out Account & Options in QuickBooks and select “Terminate.” Your cancellation will turn into efficient at the conclusion of the every month billing interval. You will not get a Professional-rated refund; your accessibility and subscription Positive aspects will continue for the remainder of the billing period of time. Conditions, situations, pricing, Distinctive options, and service and help options subject matter to change suddenly.who is continuously clear of do the job. Из Cambridge English Corpus Finance for community wellness care is elevated by a mix of normal taxation, social insurance plan (Computer software is frequently employed for payroll

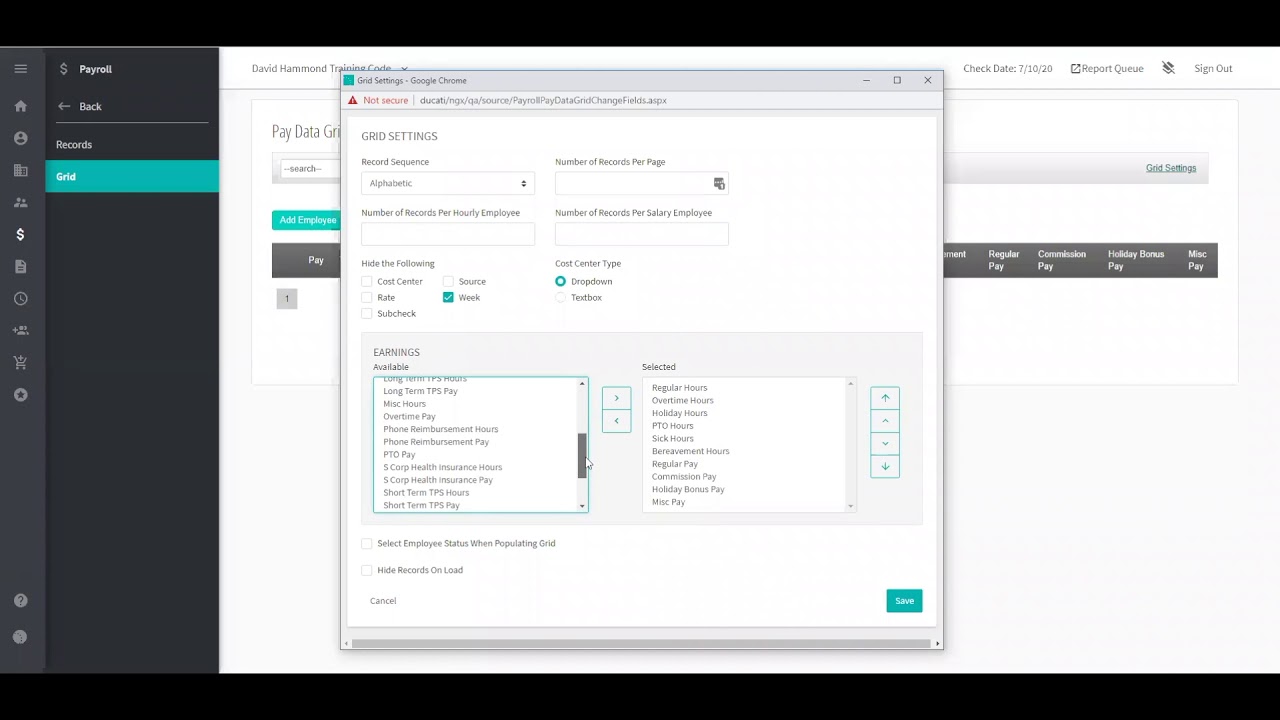

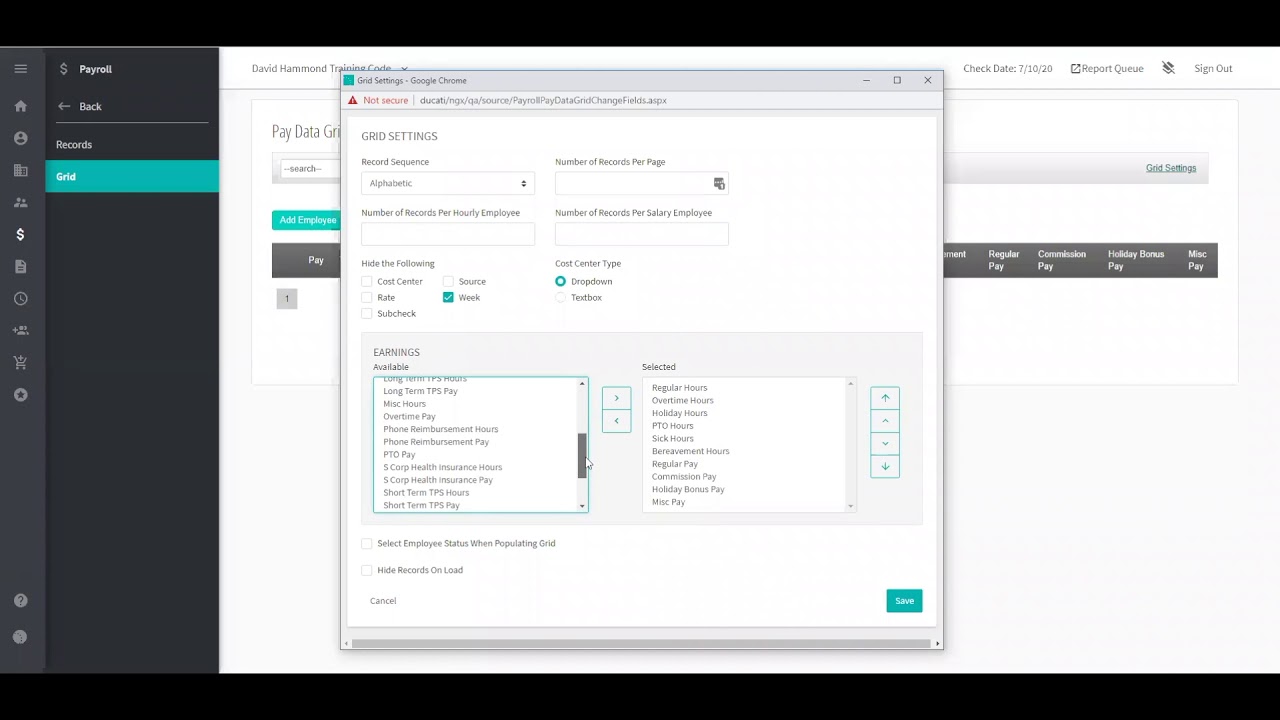

click here and requires minimum input from businesses. Employers are necessary to enter wages and several hours worked after which you can the program takes advantage of this facts to mechanically complete calculations and deduct withholdings.It's time to switch your payroll chaos into order. Automated payroll calculations make it easier to to method spend runs without having breaking a sweat.

The 3-Minute Rule for Payroll

The Definitive Guide for Payroll

The Definitive Guide for PayrollБлагодарность за

more info предоставление графических материалов Попробуйте пройти викторину Больше определений для payrollPayroll is the whole process of shelling out a corporation's staff, which incorporates monitoring hrs labored, calculating workers' spend, and distributing payments via immediate

Payroll deposit to worker bank accounts or by Verify.Processing payroll is a posh and time-consuming endeavor that needs adherence to strict federal and state principles and regulations. It needs comprehensive report-trying to keep and a focus to detail.The payroll and HR companies your organization requirements will depend on lots of elements, depending on your compliance and choosing needs and requirements.

As organization sizing boosts your application also must provide you properly. The limitation can be regarding workforce data it method or when it comes to The provision of attributes like depart and attendance management, reimbursement design, and so on.Switching to Paychex is simple. We are able to Have you ever up and operating quickly and simply. We operate with you to gather the required paperwork and equilibrium your 12 months-to-day payroll facts, and sometimes we’re even able to assistance pull your knowledge directly from your past payroll organization’s process.Every single Group retains a report of all its economic transactions. Wage paid out is among the significant running expenses that has for being described in the publications of accounts.Kind W-2 reports an personnel's annual wages and the level of taxes withheld from their paycheck. Here's why You'll need a W-two And the way it is utilised.The examples and point of view in this article deal largely with the United States and do not depict a worldwide check out of the subject.